Tax on taxable income calculator

Estimate your federal income tax withholding. That means that your net pay will be 43041 per year or 3587 per month.

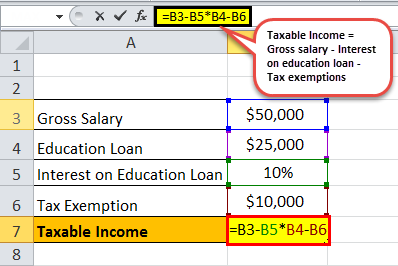

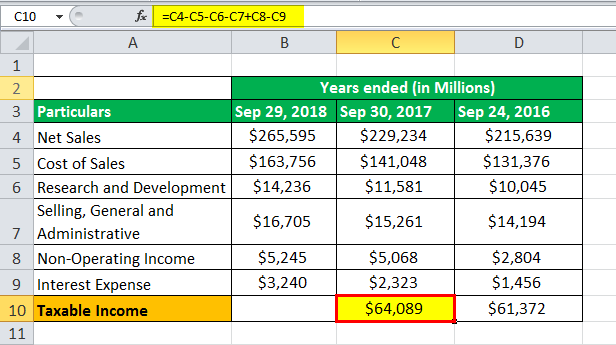

Taxable Income Formula Examples How To Calculate Taxable Income

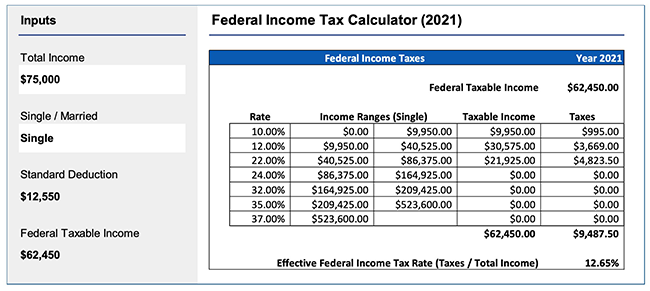

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. Tax Tax Free Income. Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes. Based on your annual taxable income and filing status your tax bracket.

Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. New York state tax 3925. The calculator will calculate tax on your taxable income only.

Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. If taxable income is under 22000. As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free.

Ad Try Our Free And Simple Tax Refund Calculator. See how your refund take-home pay or tax due are affected by withholding amount. Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income thats subject to a marginal tax rate.

A hospitality business has earnings before taxes of 10 million. Transfer unused allowance to your spouse. Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas.

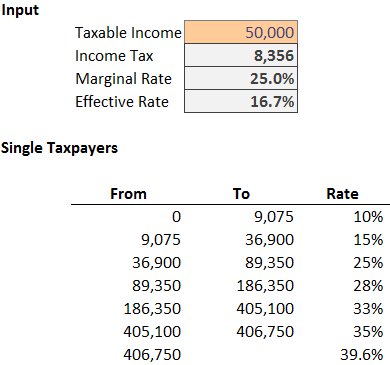

The tax is 10 of. If you make 55000 a year living in the region of New York USA you will be taxed 11959. The tax rate schedules for 2023 will be as follows.

Ad Enter Your Tax Information. Free Federal Filing for Everyone. Base on our sample computation if you are earning 25000month your taxable income would be.

Total income tax -12312. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Calculate the income tax expense and the businesss.

Check your tax code - you may be owed 1000s. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. FAQ Blog Calculators Students Logbook.

100 Accurate Calculations Guaranteed. Once taxes and deductions are in fact. Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400.

Find a List of State Tax Calculators and Estimates for Tax Year 2021 and 2022. Enter your filing status income deductions and credits and we will estimate your total taxes. However a flat rate of 5 applies to taxable income over.

Ad Try Our Free And Simple Tax Refund Calculator. 2 days agoBalers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal. TDS advance tax and self-assessment tax payments made during the fiscal year should be.

Estimate Your State and Federal Taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Use this tool to.

It can be used for the 201314 to 202122 income years. See What Credits and Deductions Apply to You. Your average tax rate is.

A tax credit is a dollar-for-dollar. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

Marginal tax rate 633. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Starting in 2022 there is no state income tax on the first 5000 of taxable income in Mississippi.

Free tax code calculator. See How Much You Can Save With Our Free Tax Calculator. Based on your projected tax withholding for the year we can also estimate.

Find content updated daily for how to figure out your taxes. The company marks an effective tax rate of 35 on this income. See where that hard-earned money goes - with Federal Income Tax Social Security and other.

The gross income of an individual is the total earnings a person receives in the taxable year before taxes and any deductions are considered. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Your household income location filing status and number of personal.

For married individuals filing joint returns and surviving spouses. 100 Accurate Calculations Guaranteed. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are. Ad Looking for how to figure out your taxes. Tax Tax Free Income.

Use the income tax bracket rate during FY 2022-23 to determine the annual tax bill. How It Works. Effective tax rate 561.

Reduce tax if you wearwore a uniform.

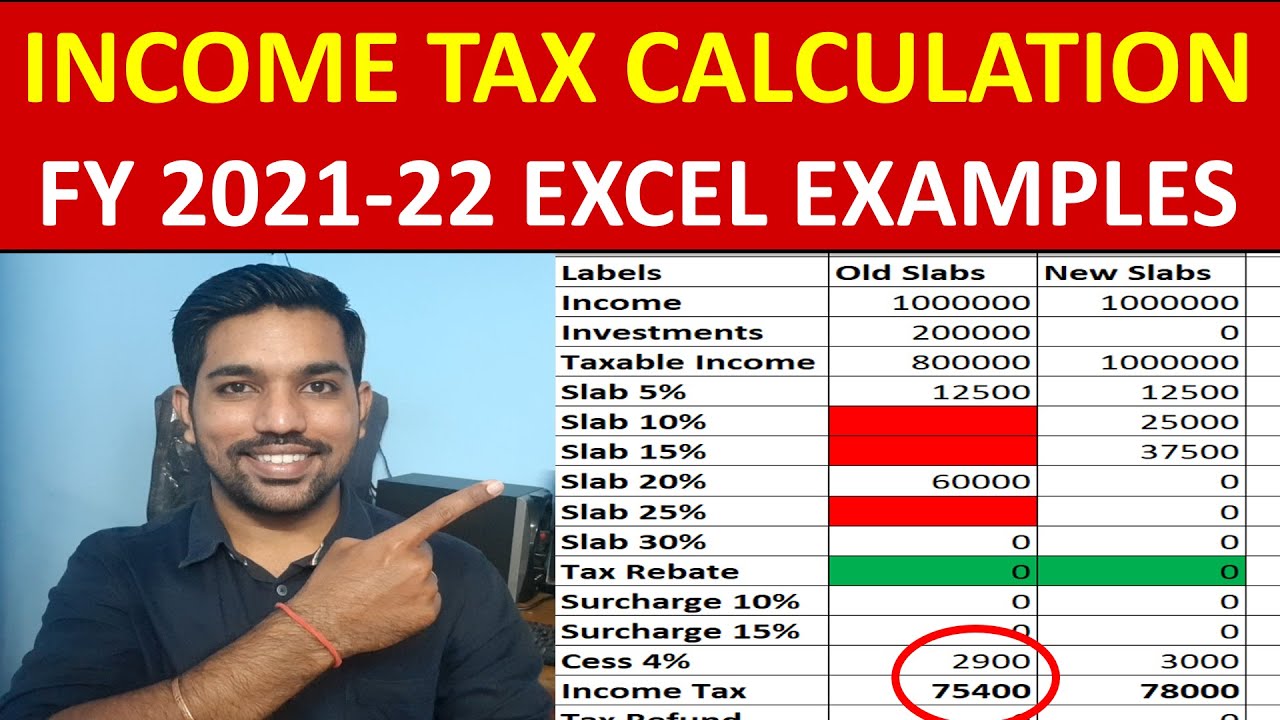

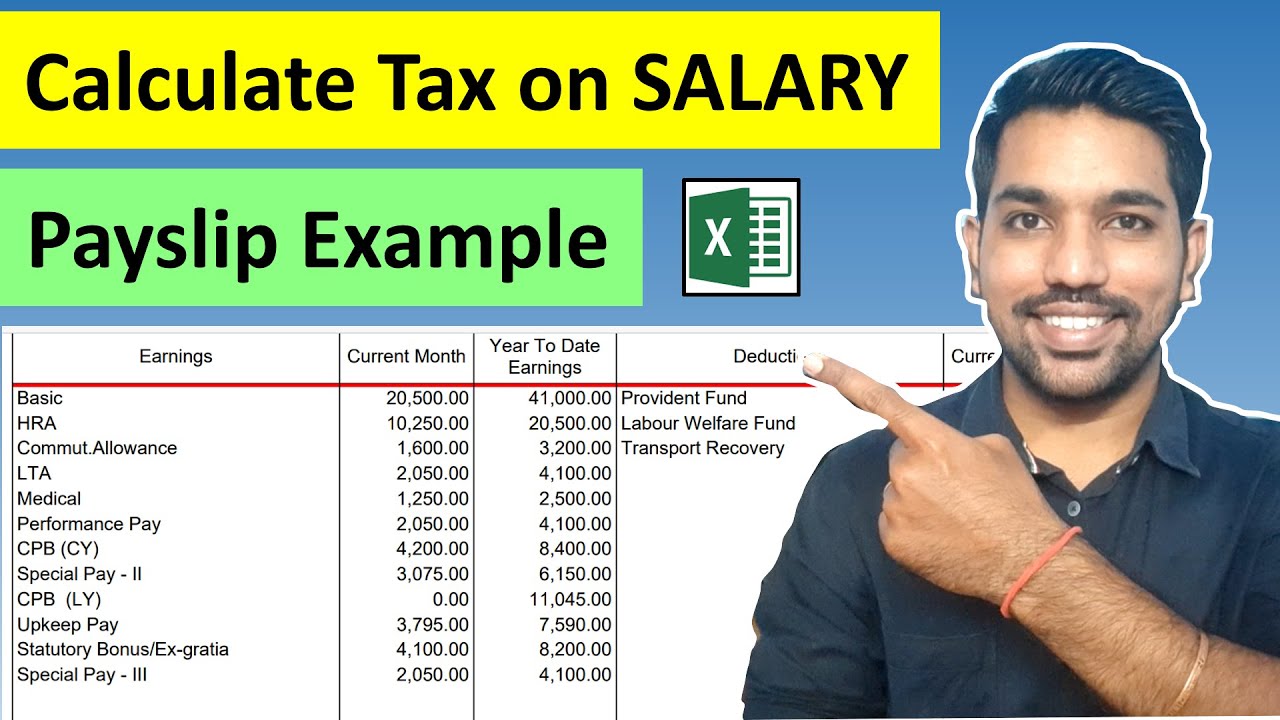

How To Calculate Income Tax Fy 2020 21 Examples New Income Tax Calculation Fy 2020 21 Youtube

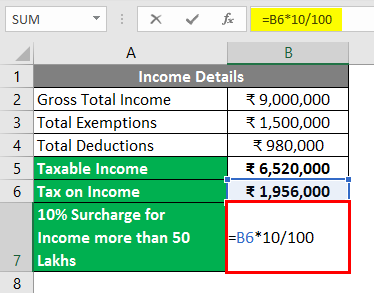

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Income Tax Formula Excel University

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Income Tax In Excel

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Taxable Income Formula Examples How To Calculate Taxable Income

Inkwiry Federal Income Tax Brackets

Taxable Income Formula Examples How To Calculate Taxable Income

Effective Tax Rate Formula Calculator Excel Template

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Formula Excel University